Put option formula

I Pe N-d2 e-rt Pa N-d1 black scholes or. Open an Account Now.

First Week Of Ea May 20th Options Trading Option Trading Options One Week

The put-Call Parity formula states that the return from holding a short put and a long call option for a stock should provide an equal return as.

. S Spot Price. PV x Present Value of the Strike Price being x This equation suggests there shall be an equilibrium between the call option and the put. P Price of the Put Option.

Assume that John buys one put option at 300 for 100 shares of the company. Phileft d1 right frac e -frac d1 2 2 sqrt 2pi. A Superior Option for Options Trading.

If BP share price is expected to be 58 and 61 tomorrow and day after tomorrow respectively when it would be profitable to exercise the. S underlying price per. They are due to expire in 2 days.

If you want to calculate the value of the put option then we will need 2 parameters. Put Option Formula. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

According to the Black-Scholes option pricing model its Mertons extension that accounts for dividends there are six parameters which affect option prices. Ad Download Smart Options Strategies free today to see how to safely trade options. Ii c Pa Pe e-rt put call parity.

Ad Instant access to real-time and historical options market data. Call and put options formulas are generally used to determine if exercising an option is the best way to go or not. Which one do we use to calculate value of put option.

Formula delta Nd1 - 1 small. A put option increases in value meaning the premium. Ad Gain access to the Nasdaq-100 Index at 1100th the notional value.

Including trades quotes aggregates and reference data. The exercise price The current market price of the underlying asset. For either of these formulas a result with a minus - presents a loss while a.

At Stock Options Channel our YieldBoost formula has looked up and down the QQQ options chain for the new October 19th contracts and identified one put and one call. If the option expires unprofitable or out of the money nothing happens and the money paid for the option is lost. Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Ad Download Smart Options Strategies free today to see how to safely trade options. Smart Options Strategies shows how to safely trade options on a shoestring budget. Compare strike price with market price of the underlying stock get intrinsic value Subtract the intrinsic value from the options market price get time value Only two things vary.

What is the Put-Call Parity Formula. In total one put costs 300 since one put represents 100 shares of ABC Company. The delta of an option measures the amplitude of the change of its price in function of the change of the price of its underlying.

Smart Options Strategies shows how to safely trade options on a shoestring budget. Free Education No Hidden Fees and 247 Support. Theta -frac Sphileft d1 right sigma 2sqrt trKe -rtNleft -d2 right small where.

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

First Week Of October 16th Options Trading For Enterprise Products Partners Epd Option Trading Trading Options

Rd Sharma Class 11 Solutions Chapter 23 Straight Lines Ex 23 15 Math Vocabulary Solutions Class

Implied Volatility Formula

Pin By Arturo Rodriguez On Finance Option Pricing Pricing Formula Stock Options

Pin On Options

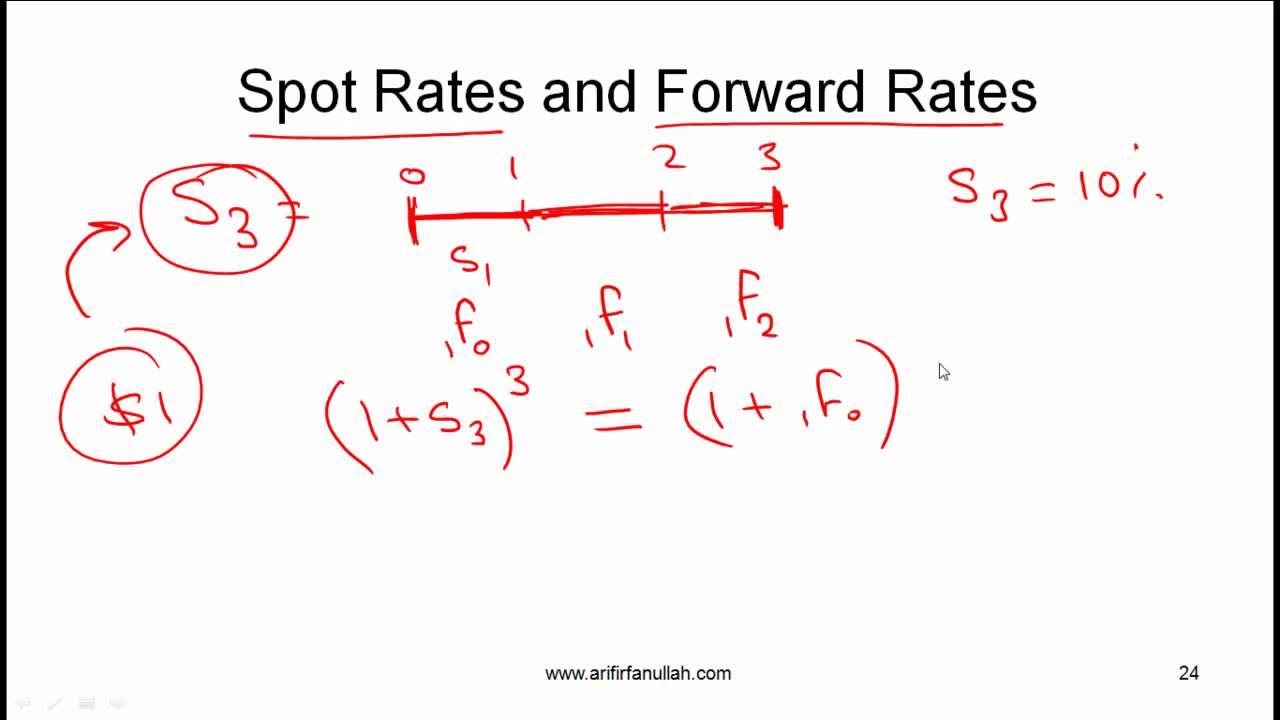

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Ncert Solutions For Class 10 Maths Chapter 6 Triangles Ex 6 2 Q 4 Ncertsolutions Cbseclass10maths Maths Solutions Maths Ncert Solutions Maths Formula Book

Interesting Siri Put And Call Options For August 28th Call Option Options August 28

Put Call Parity Refers To The Static Price Relationship Between The Prices Of Put And Call Options Of An Asset With Th Exam Fisher College Of Business Formula

Interesting Yum Put And Call Options For February 26th Call Option Options February

A Financial Option Is A Financial Derivative That Involves A Contract To Buy Or Sell An Underlying Asset Stock Options Trading Option Trading Option Strategies

Interesting Nvda Put And Call Options For December 24th Call Option Options December

What Is A Financial Option The Complete Beginner S Guide To Financial Options Accounting Education Financial Options

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Pin By Anand Masurkar On Stock Market Quotes Stock Market Quotes Marketing Meme Stock Market

Icse Soiutions For Class 10 Mathematics Factorization Maths Formula Book Mathematics Math Methods